The GST Portal has recently issued an update, introducing the option to make GST payments through *Credit Cards and *Debit Cards. To utilize this feature, taxpayers should opt for the E-payment option, where they will find a specific section dedicated to Credit/Debit Card payments.

It is essential for taxpayers to carefully review the transaction charges associated with each payment method, particularly when selecting Credit Cards, Debit Cards, or Bhim UPI sub-payment modes.

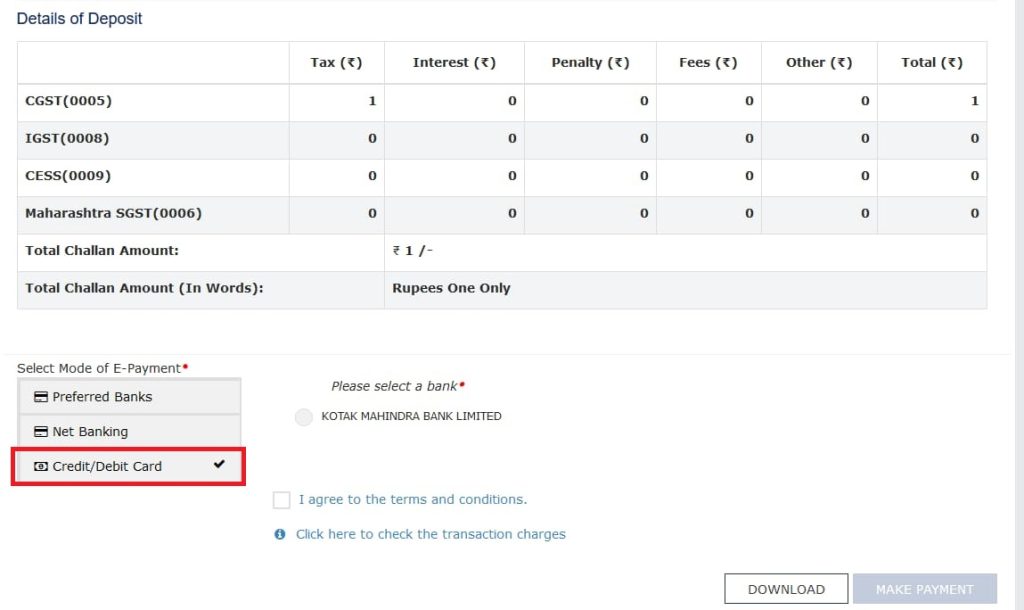

To proceed with Credit/Debit Card payments, users need to follow these steps:

- Select the E-payment option.

- Within the E-payment section, choose the Credit/Debit Card option.

- Subsequently, select the preferred bank for the transaction.

- Tick the agreement box for terms and conditions.

- Click on the “Make Payment” button to complete the transaction.

*Facility started in 10 States/UTs from 5th January 2024

1.Assam

2.Delhi

3.Goa

4.Gujarat

5.Haryana

6.Himachal Pradesh

7.Kerala

8.Madhya Pradesh

9.Maharashtra

10.Odisha

The rest of India and Banks are to be covered soon.

*Applicable for all Credit/Debit cards powered by Rupay, MasterCard, Visa, and Diners at present via Kotak Mahindra Bank